Date | Jun 14, 2016:

PwC's latest report into the performance of the world's 40 largest mining companies shows just what a watershed year 2015 was.

The management consultants' Mine 2015 report shows the top 40 companies suffering their first collective net loss in history ($27 billion), a decline in collective market capitalization of 37% (to below half a trillion dollars from a peak of $1.6 trillion in 2010), the lowest return on capital ever, asset impairments totalling $53 billion (for a total of nearly $200 billion since 2010), record high leverage of 46% and operating expenditure cuts of $83 billion.

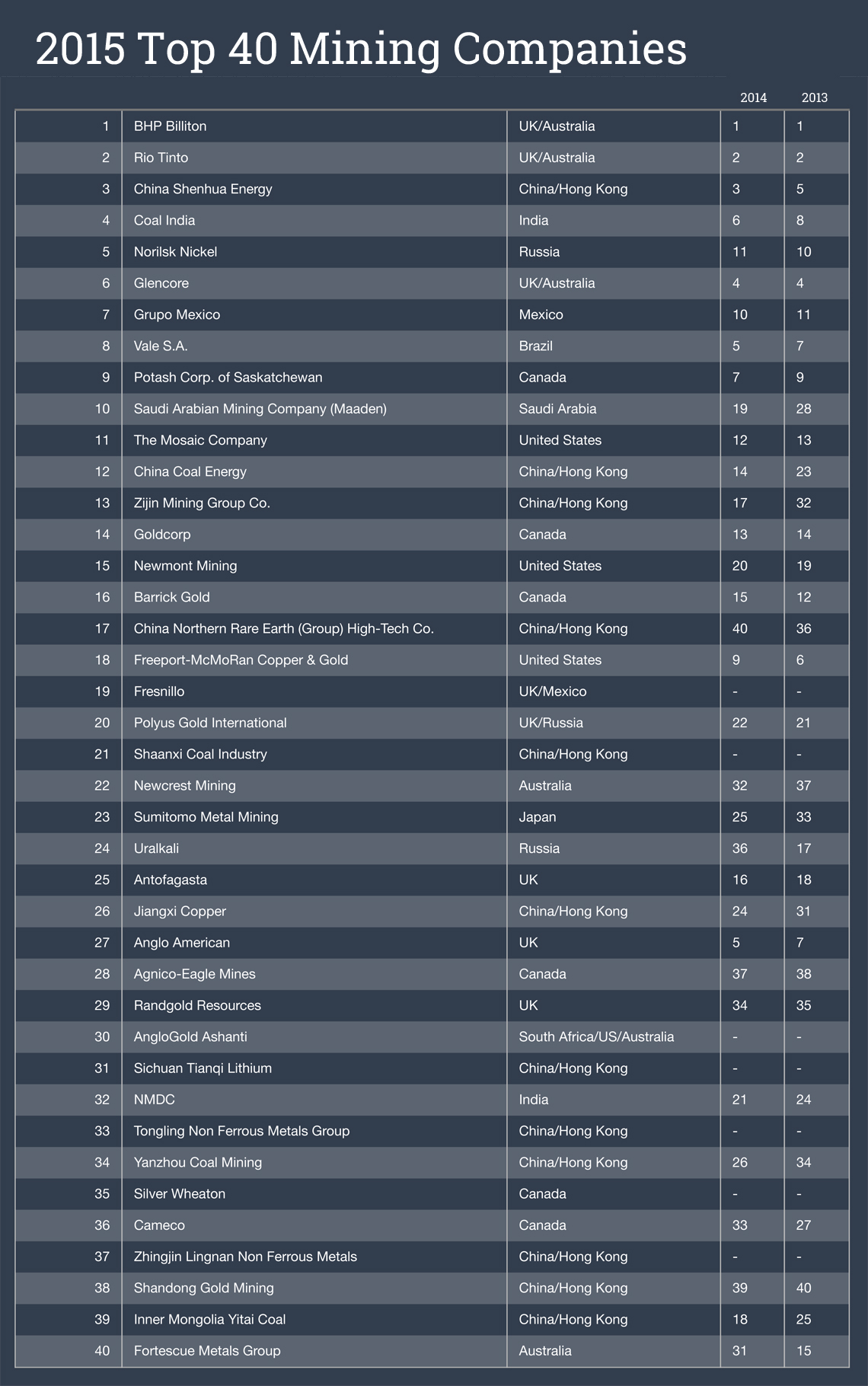

The entries, re-entries and movements up and down the ranking also provides insight into the changing landscape of global mining.

The authors point out that the market capitalization threshold for attaining Top 40 status remained consistent at $4.5 billion despite "the huge decreases in value of the top mining companies, and demonstrates that the new entrants are catching up."

China is featuring more heavily. All four companies admitted to the list for the first time was from China, pushing out Canada's First Quantum and Teck Resources. China now provides 12 of the top 40 listed mining firms versus six from Canada despite one Chinese firm dropping out.

Gold's changing fortunes saw AngloGold Ashanti re-emerge in the ranking for the first time since 2013 although other top gold producers Goldfields and Kinross haven't made it back onto the list. When grouped by primary commodity mined gold producers still lost a combined $12 billion in market value.

The only sector to show an increase in market value was rare earths with the world's top producer of the 17 elements jumping 23 places in the ranking. Another technology mineral is showing up for the first time.

Even though it's early days for the lithium boom, the Top 40 has already welcomed its first miner of the battery raw material. Sichuan Tianqi Lithium enters as the world's 31st most valuable miner helped by a doubling of the price of lithium carbonate just over the final months of 2015 and predictions of explosive growth in demand spurred by the electric vehicle and mass grid storage market.

Download the PwC report here

Source: PwC Mine 2015

(Source: http://www.mining.com/)