Date | Sept 06, 2017:

The central government has decided to simplify the Mineral Auction Rules, 2015, with the aim of encouraging more companies to participate in non-coal auctions. Through these proposed amendments, the Centre wants to lower the limit of minimum net worth that a company must have to participate in auctions. The draft rules also plan to permit state governments to proceed with auctions if — even in the second attempt — the number of technically qualified bidders for a mine remain less than three.

The amendments — which are at a draft stage currently — will also prevent the company that has won the bid from “squatting” on the mine and adopting “delaying tactics”. Moreover, it will allow the state government to use the “all-India average sale price by Indian Bureau of Mines (IBM)” as a benchmark for auctions if the state’s average sale price is not available.

The Central government has asked the stakeholders to send their comments on these proposed amendments by September 30. As per the new mining law — Mines and Minerals (Development and Regulation) Amendment Act, 2015 — which came into effect from January 2015, non-coal mines have to be auctioned by the respective state governments. Under the old mining law, the states had the powers to grant the mining lease to any company as per their discretion.

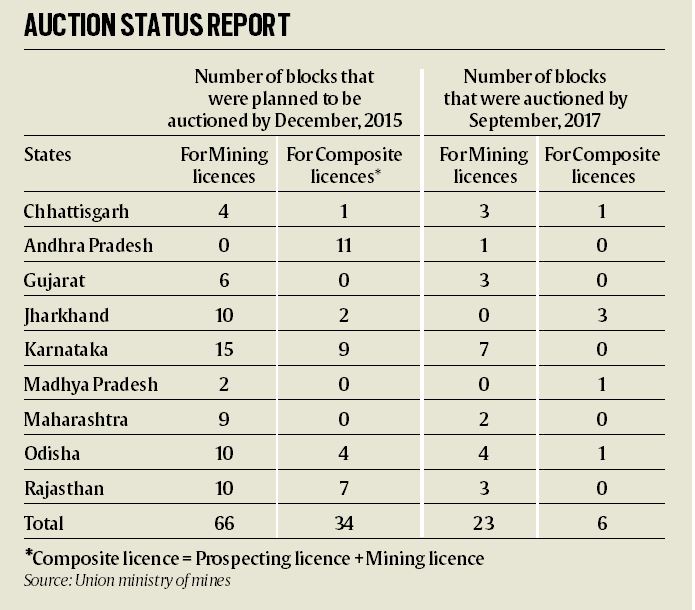

In June 2015, several mineral-rich states presented a non-coal mineral auction plan to the Centre. Showing their readiness, the state governments told the Central government that 100 mines would be auctioned by December 2015. However, until now, the states have been able to auction only 29 mines.

“The amendments (in mineral auction rules) are aimed at ironing out some of the practical difficulties faced by the governments on past auctions. It’s encouraging to see the opportunity open to a larger set of bidders. This helps new entrants with innovative extraction technologies but having lower net-worth become eligible,” said Kameswara Rao, leader — energy, utilities and mining, PwC India.

Schedule I of the Mineral Auction Rules, 2015, talks about the net worth requirements that are applicable to companies or individuals who are participating in auction. The Schedule I currently states that if the “value of estimated resources (VER)” — which is calculated by multiplying the estimated quantity of mineral with the average sale price of that mineral — is less than Rs 25 crore, the company must have a net worth of more than 2 per cent of the VER.

The Schedule I also states that if VER is more than Rs 25 crore, the company must have a net worth of more than 4 per cent of the VER. The proposed amendments have relaxed these requirements, stating that the company only needs to have a net worth of one per cent of the VER now. In case the VER is more than Rs 500 crore, the amendments propose that the company would need to have a net worth of 2 per cent of the VER.

“The government is trying to encourage the smaller players with such steps. Earlier, if the VER of an iron ore mine was Rs 450 crore, the company — participating in auction — would need a net worth of minimum Rs 18 crore. If the proposed amendments to the mineral auction rules are adopted, any company with a net worth of more than Rs 4.5 crore can bid for this iron ore mine,” said a former Union mines secretary.

The mineral auction rules 9(4)(a)(iv) currently state that a state government can proceed with auction if, at its third or subsequent attempt, the number of technically qualified bidders are less than three. According to a mines ministry official, several governments have complained about this clause, stating that they have to annul many auctions because of such strict criteria.

On October 8, 2016, the then Union mines secretary Balvinder Kumar gave a presentation in Vadodara to stakeholders of the sector, stating that state governments had to annul auctions of 37 mineral blocks due to insufficient number of applications of initial bids for blocks.

The explanatory note of the Central government, which has been attached with proposed amendments to mineral auction rules, also talks about this issue. It states: “It has been seen that the stipulation of minimum three technically qualified bidders has resulted in annulment of many auctions. State governments have requested that they should be empowered to proceed with the auction process with less than three technically qualified bidders.”

Therefore, the proposed amendment allow the state government to proceed with auction if, at its second attempt, the number of technically qualified bidders are less than three. The explanatory note states: “A good mineral block will anyway attract more than three bidders and therefore the provision is being amended to allow the state government to continue with the auction process if in the second round the total number of technically qualified bidders are less than three.”

Rule number 10 (6) currently states that the mining lease/licence shall be “executed by the state government within thirty days of the date of completion of the conditions” by the company that has won the bid. Through the amendment, the government has proposed adding one clause to this rule, which states that if a time period of three years has passed “from the date of (granting) the letter of intent”, no mining lease deed shall be executed and the “letter of intent will be invalidated leading to annulment of the entire process of auction and the state government may grant the mineral block only through a fresh auction process”.

According to the Central government’s explanatory note, this particular amendment “will prevent squatting and adoption of delaying tactics that a successful bidder may adopt for some reasons; and will ensure commencement of mining at the earliest”.

(Source: http://indianexpress.com/)