New Delhi | March 28, 2017: In a historic step aimed at boosting India’s coal supply, the Narendra Modi government is planning to start commercial mining of coal by bidding out 30 million tonne of reserves in the first phase through forward auction with no end-use restriction for companies.

This would be the first time in more than four decades India would embrace the idea of commercial sales of the fuel – a key raw material for industries including power, steel and cement. Commercial coal mining was in vogue in India up to 1973 when the then Indira Gandhi government nationalized the coal sector.

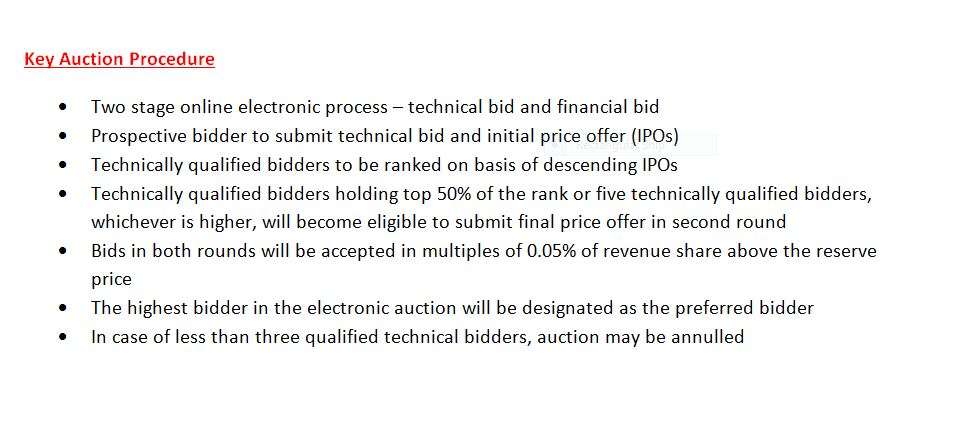

The coal ministry has floated a discussion paper detailing key aspects of the planned auction process – under the provisions of the Coal Mines (Special Provisions) Act of 2015 -- inviting comments from stakeholders.

“While Coal India Ltd has set itself a target of doubling its production within 5 years to 1 billion tonne, given the present demand-supply situation and the projected economic growth of the country, it will be necessary to further augment production through commercial mining,” the Discussion paper on Auction of Coal Mines for Commercial Mining said.

The ministry has proposed a revenue-sharing model for companies that make “windfall gains” in case of a significantly-superior business cycle. “While the successful bidder shall be free to decide its marketing and pricing strategy, the revenue sharing will be calculated on the basis on actual revenue or actual production multiplied by 1.2 times the CIL Run of the Mine (ROM) price for the average grade of coal for the specific time, whichever is higher,” the paper said.

However, according to a sector expert, the idea of revenue sharing might not be a good idea for the coal sector.

"Also, it is unclear if difficult coal blocks will have the margin because at the end of the day, difficult coal blocks will have higher cost of production," the expert said.

As per the proposed regulations, a commercial miner will have full flexibility to decide pricing and selling strategy and have a certain degree of flexibility to manage production depending on the market scenario. “It should be allowed to reduce its production below Peak Rate Capacity (PRC). It may also be allowed to increase its production subject to a revision in mining plan,” the ministry proposed.

In order to attract large players, the ministry has said, the mines earmarked for auction should be large enough and should allow highly-efficient recovery of coal so as to “make reasonable impact on the overall demand supply position”.

On the eligibility criteria of the companies participating in auctions, the ministry said the tangible net worth of the bidder should not be less than Rs 1,500 crore and the entity should have experience of excavating and handling at least 25 million cubic meters per annum of broken rock strata in any coal, iron ore, limestone, bauxite and manganese mine in the last three consecutive financial years.

Under the new regulations, while the successful bidder will be allowed to manage his production quantity (subject to the cap in the mining plan) in the event of any economic downturn or other such event, a drop in the actual production is allowed, not below 50 per cent of production as per the mining plan. “However, in any five year block, the successful bidder will have to mine at least 70 per cent of the production as per the mining plan,” the discussion paper said.

The successful bidder will pay an upfront payment equivalent to 10 per cent of the annual turnover value of coal in three instalments – 50 per cent upon execution of the mining agreement, 25 per cent upon execution of mining licence and remaining 25 per cent upon grant of mine opening permission.

The government plans to offer coal of G11-G13 grade range in the auction. State-owned miner Coal India currently supplies non-coking coal in 16 grades with decreasing range of calorific value from G1 to G16. For public sector companies, the government has proposed to keep a separate window for allotment of commercial mines.

(Source: http://energy.economictimes.indiatimes.com/)