Date | Feb 15, 2017:

Even as the auction of non-coal mines — which began in early 2016 — has received a tepid response from the industry till date, 10 mineral-rich states have now prepared an ambitious plan to auction total 71 such blocks in 2017-18.

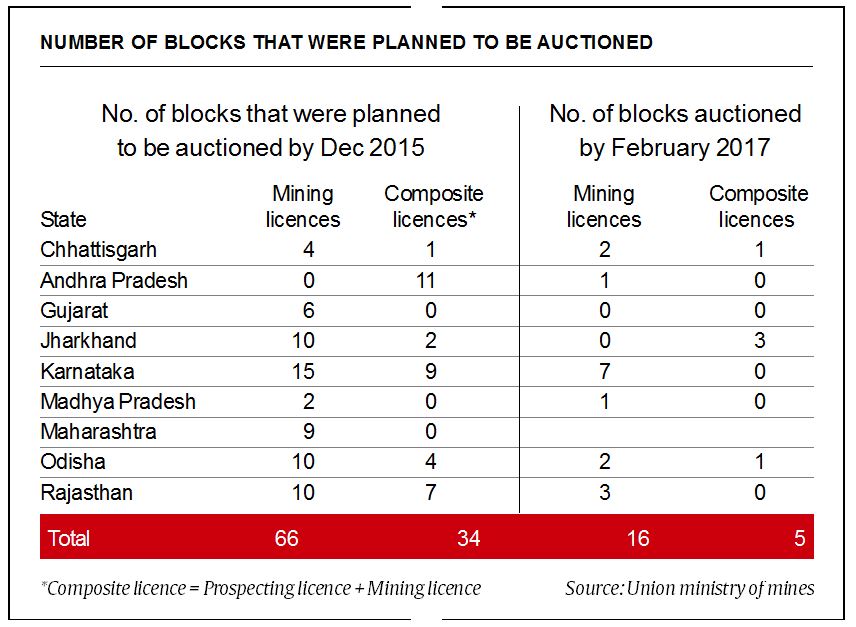

According to the Union mines ministry, the states have been able to auction only 21 mines so far. In June 2015, various mineral-rich states presented a non-coal mineral auction plan to the Central government, wherein they stated that 100 mines would be auctioned by December 2015. Unlike coal auction, it was the states that were going to conduct the auction for non-coal minerals.

Now, the states have presented a fresh auction plan for 2017-18. As per the plan, 22 iron ore mines and 21 limestone mines would be auctioned by these mineral-rich state governments in the coming financial year. Many mines, which did not find any bidders earlier, would now be re-tendered for auction in the next financial year — out of total 71 mines, 16 mines and three mines would be tendered for the second time and third time, respectively.

According to a presentation by Balvinder Kumar, Union mines secretary, to various stakeholders on October 8, 2016, in Vadodara, the state governments had to annul the auction of 37 mineral blocks due to insufficient number of applications of initial bids for blocks. Seeing the lukewarm response from the industry, many mines — out of the 100 that were listed before Central government in June, 2015 — were not put up on auction altogether.

The mines secretary then listed the reasons in front of the stakeholders: The quantity and grade of the ore, quality of exploration data, land ownership pattern, dull market scenario, end-use conditions imposed by the states and apprehensions on average sale price notified by the Indian Bureau of Mines (IBM).

According to the latest data of Union mines ministry, the auction of the first 21 non-coal mines is estimated to bring a total revenue of Rs 73,359 crore over the next 50 years for the respective state governments.

“Basically, the area was less for some mines. In some cases, the mineral quality or exploration data was not up to the mark. In some cases, the location was not right for the companies. For some mines, the states had put the condition that the mining lease (ML) would be awarded for captive uses only,” Kumar told The Indian Express in October 2016. “For example, the Gujarat government was unable to auction limestone mines in Kutch district as the companies are not willing to set up a captive plant there. There are some issues propping up as the area is either a forest area or a Naxal-infested area,” he added.

However, the secretary clarified that land acquisition has not been an issue as yet for non-coal mineral auctions. “The states keep acquiring the land as and when it is required. But we did not hear from the states that companies are not participating in auction due to any land acquisition issues,” he said.

As per the new mining law — Mines and Minerals (Development and Regulation) Amendment Act, 2015 — which came into effect from January 2015, the non-coal mines have to be auctioned by the respective state governments. Under the old mining law, the states had the powers to grant the mining lease to any company as per their discretion.

The 2015 mining law clearly states that if a company has already got the mining licence (ML) of a non-coal block for captive purposes, it can continue to mine it till the lease period ends. Once it ends, such a company will have the first right of refusal. Moreover, the law stated that if a company has the ML of a block for non-captive purposes, the company can keep the mine till 2020 or till the lease period ends, whichever comes earlier.

While the Union mines ministry was busy passing this mining law in Parliament at the beginning of 2015, the coal ministry was busy preparing for the auction of few of the 214 coal mines that were de-allocated following the Supreme Court order of September 24, 2014. The Supreme Court had explicitly stated that companies would have to return the coal blocks by March, 2015.

Therefore, as the coal ministry was working on a deadline, the first phase of coal auction was conducted in February 2015. The three phases of the coal auction for close to 45 coal-producing blocks were conducted in the seven month period of February-August in 2015. As per coal ministry estimates, the auctioned mines are expected to fetch the mine-bearing states a cumulative revenue of Rs 3.5 lakh crore over a 30-year period. Both power and non-power sector participated in the same. For the government, it was a big success.

However, the coal ministry had to cancel the plans to conduct the fourth tranche of coal auctions, which were planned in January, 2016, as there was lack of demand from iron, steel and cement plants. The fourth tranche of coal auctions were for them only. This was the time when the state governments had begun the process of non-coal mineral auctions.

Now, on February 2 this year, the coal ministry announced that it is going to auction 23 coal mines in the coming financial year — four of them would be put for commercial mining auction. And just like Union mines ministry, it is hoping that this time, industry would be much more interested in participating in the bidding process.

(Source: http://indianexpress.com/)