You are here :

Home Carbon Neutral vs Net Zero - What's the Difference?

|

Last Updated:: 24/02/2025

Carbon Neutral vs Net Zero - What's the Difference?

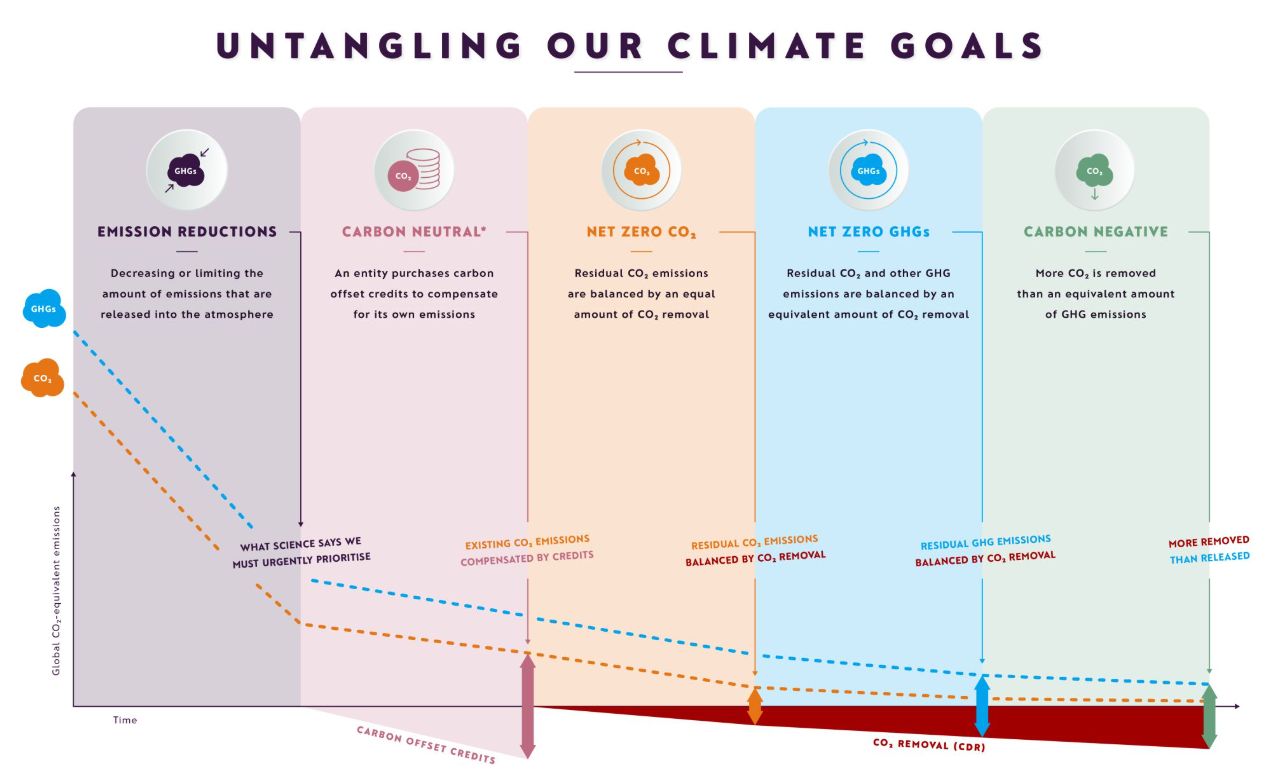

Understanding the distinction between "carbon neutral" and "net zero" is essential for making informed decisions in climate action.

What is Carbon Neutral?

- Balancing CO₂ emissions with equivalent removal or offsetting.

- Achieved through carbon credits, reforestation projects, or renewable energy investments.

- Focuses on immediate action to balance emissions without necessarily reducing them.

What is NetZero?

- Involves drastically reducing all greenhouse gas emissions (CO₂, methane, nitrous oxide, etc.) to as close to zero as possible.

- Emphasizes cutting emissions at the source and offsets only as a last resort.

- Requires long-term systemic changes, such as adopting renewable energy and increasing energy efficiency.

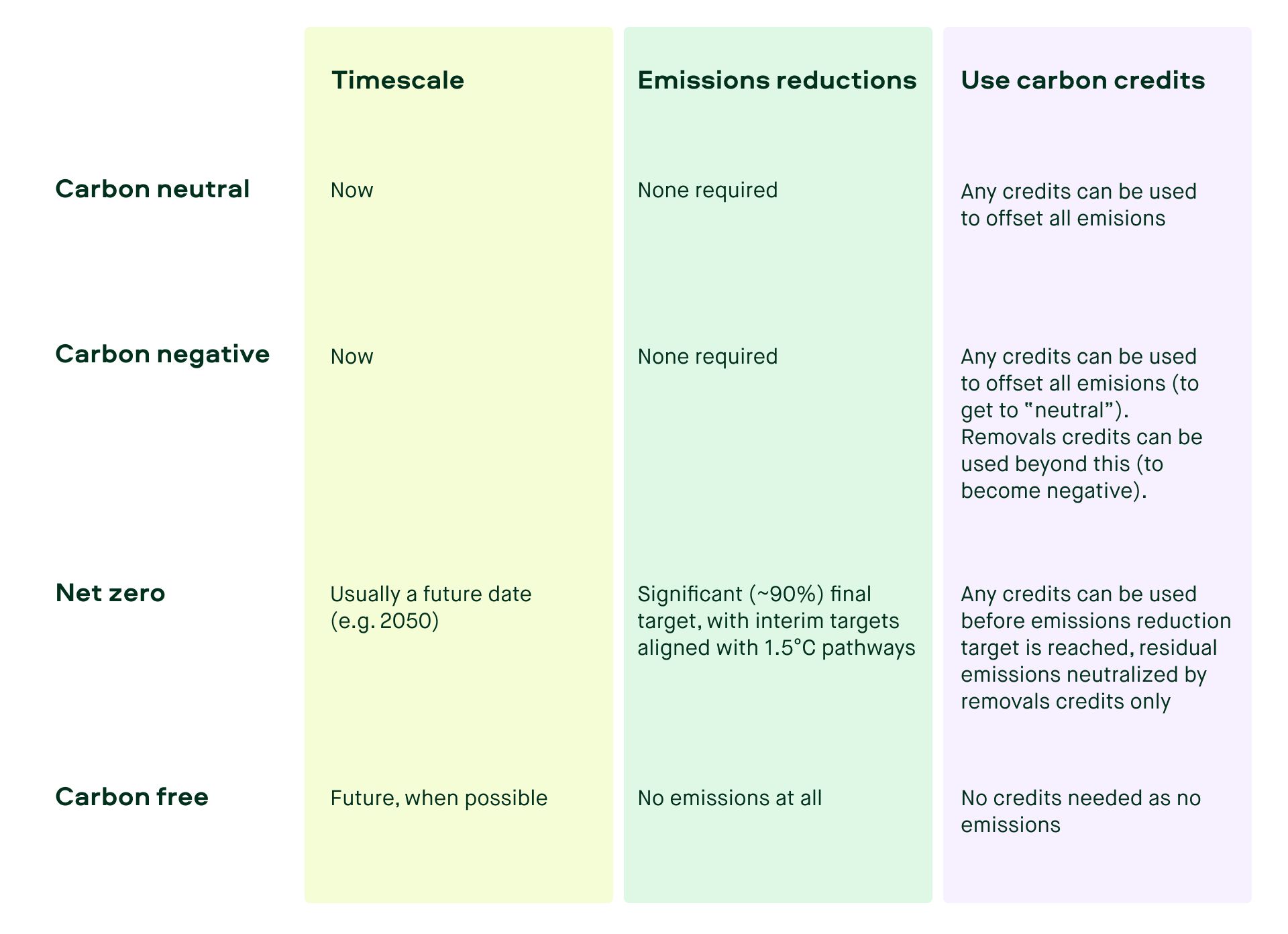

Key Differences

Scope: Carbon neutrality focuses on CO₂; net zero covers all greenhouse gases.

Approach: Carbon neutrality often relies on offsets; net zero prioritizes emission reduction at the source.

Timeframe: Carbon neutrality can be achieved quickly; net zero requires systemic and long-term efforts.

Impact: Carbon neutrality balances emissions but doesn’t necessarily reduce them; net zero aims for substantial reductions and sustainability.

Additional Terms Explained

Carbon Negative: Removing more CO₂ than emitted, effectively reducing overall carbon levels.

Carbon Positive: Synonymous with carbon negative, focusing on creating a net-positive impact.

Climate Positive: Beyond neutral, creating additional environmental and societal benefits.

Carbon Zero: Producing no carbon emissions, typically through renewable energy.

Climate Neutral: Balances all greenhouse gases, ensuring no net contribution to climate change.

Important Standards and Regulations

PAS 2060: International standard for achieving and certifying carbon neutrality.

Science-Based Targets Initiative (SBTi): Aligns corporate climate goals with the latest climate science.

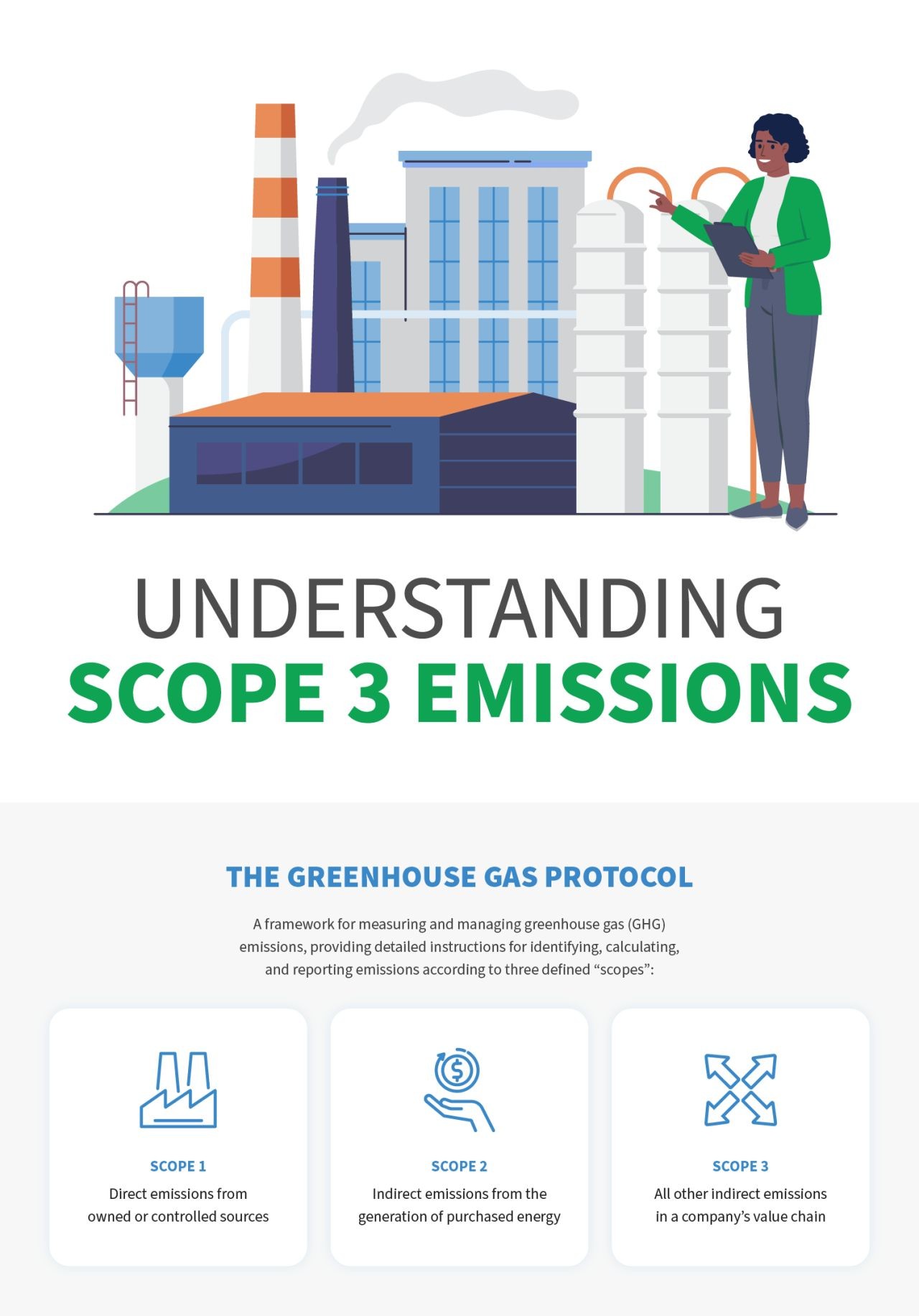

GHG Protocol: Global standard for calculating and categorizing emissions across Scopes 1, 2, and 3.

Corporate Sustainability Reporting Directive (CSRD): EU directive requiring enhanced sustainability data disclosure.

Streamlined Energy and Carbon Reporting (SECR): Simplifies energy use and emissions disclosures in the UK.

Ready to Take Action?

Analyze emissions across operations and supply chains, including direct (Scope 1), indirect (Scope 2), and value chain (Scope 3) emissions.

Identify hotspots and take targeted actions to reduce emissions.

Use tools like the CarbonCloud platform for accurate and compliant emissions data.

#CarbonNeutral || #NetZero || #ClimateAction || #Sustainability || #GreenhouseGas || #CarbonFootprint || #RenewableEnergy || #CarbonAccounting || #ClimateNeutral || #SustainableFuture || #FoodWaste || #CircularEconomy || #SustainableAgriculture || #RegenerativeFarming || #Transparency || #CarbonCredits || #EmissionReduction || #ClimatePositive || #CarbonOffset || #EnvironmentalImpact

(Source: LinkedIn Post by: Sachin Sharma )

Understanding Scope 3 Emission

As the world races to combat climate change, Scope 3 emissions have emerged as a critical focus in the journey towards decarbonization. While businesses have made strides in accounting for Scope 1 and Scope 2 emissions, Scope 3 emissions—representing 90% of total emissions in many organizations—remain under-explored. Here's why companies must start preparing for Scope 3 emissions accounting now:

Why Scope 3 Emission Matters?

- Largest Share of Emissions: Scope 3 emissions, often 26x higher than operational emissions (Scopes 1+2), present the biggest opportunity for reducing carbon footprints. Without tackling Scope 3, decarbonization efforts remain incomplete. Net-zero goals are impossible without comprehensive Scope 3 tracking.

- Future Regulatory Compliance: While currently voluntary, trends indicate mandatory reporting of Scope 3 emissions is on the horizon. Companies must proactively prepare to stay ahead of global sustainability regulations.

- Investor Confidence: Investors favor companies with transparent carbon accounting, including Scope 3. According to the World Economic Forum, addressing Scope 3 reduces financial risks and boosts investor trust.

- Competitive Advantage: Early adopters of Scope 3 accounting gain a head start in supply chain sustainability and market positioning. Businesses prepared for mandatory reporting will face fewer compliance risks.

- Improved Climate Impact: By addressing Scope 3, companies enhance their climate impact transparency, reducing future risks like penalties and carbon costs.

- Long-term Financial Resilience: Tackling Scope 3 emissions leads to cost efficiencies and strengthens shareholder confidence. A robust financial case exists for companies committing to Scope 3 reduction.

Challenges in Scope 3 Emission Accounting

Despite its importance, Scope 3 accounting faces unique challenges:

- Data Collection: Relying on third-party data often leads to accuracy and transparency issues.

- Complex Value Chains: Navigating emissions across multiple suppliers and customers is resource-intensive.

- Limited Control: Organizations lack direct control over upstream and downstream activities, complicating target setting.

Why Start Now?

Global climate commitments are accelerating, and businesses that act now will future-proof themselves. Addressing Scope 3 helps identify emission hotspots, enabling meaningful action to mitigate climate impacts. It’s not just about compliance—it’s about leading the way towards a sustainable future.

#Scope3Emissions || #CarbonAccounting || #Sustainability || #Decarbonization || #NetZero || #ESG || #ClimateAction || #SustainableBusiness || #GHGAccounting || #GreenEconomy

(Source: LinkedIn Post by: Sachin Sharma)